Facebook Ads Data You Won’t Believe!

Table of Contents

Meta has released some fascinating new data for Q1 2023. It includes some fantastic news for Facebook advertisers and Instagram advertisers.

In this blog, I break down the highlights and show you what’s happening with Meta and Facebook specifically right now… And what is likely to happen to Meta and Facebook going forward.

Introduction:

Recently, Meta has released some fascinating new data for Q1 2023 in which some groundbreaking statistics were shared that have the potential to reshape the way we perceive the future of Facebook and Instagram advertising.

These figures were released as part of Meta’s Q1 reports, offering surprising insights that will captivate advertisers. Let’s delve into the highlights and explore the implications of this data.

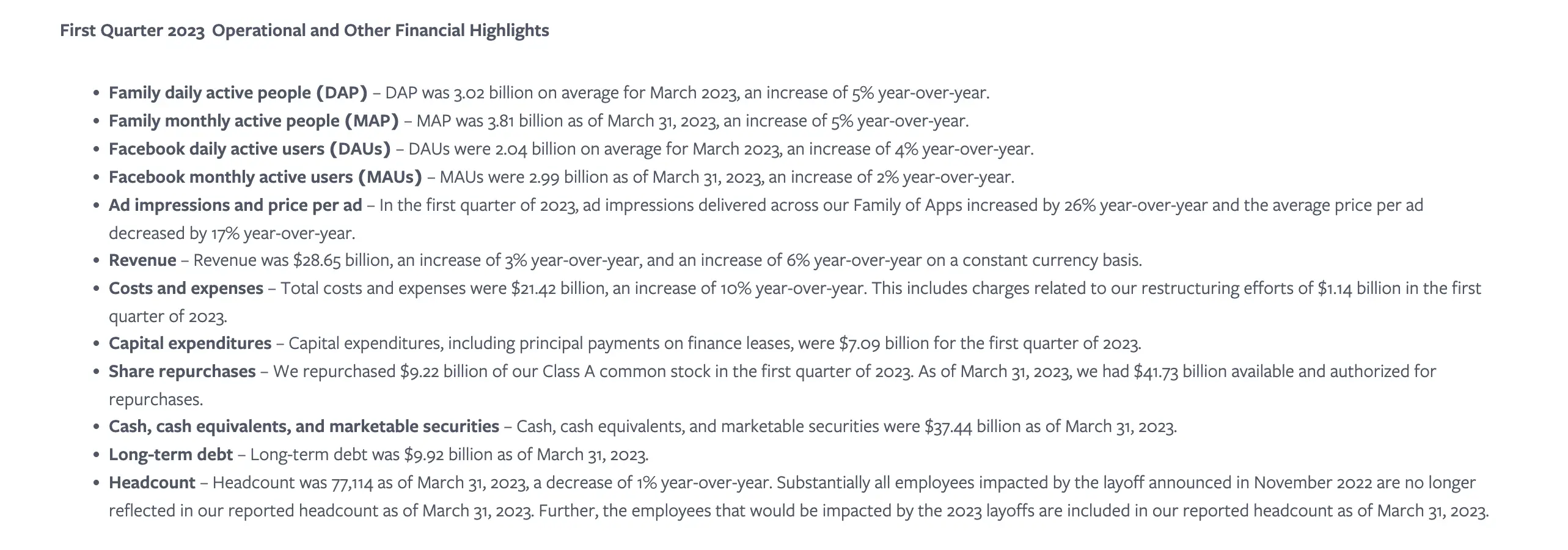

Here are some of the key takeaways from Meta Reports First Quarter 2023 Results:

- Meta Platforms, Inc. (formerly Facebook) reported financial results for the first quarter of 2022.

- Revenue was $28.6 billion, an increase of 3% year-over-year.

- Costs and expenses were $21.4 billion, an increase of 10% year-over-year.

- Income from operations was $7.2 billion, a decrease of 15% year-over-year.

- Operating margin was 25%, down from 31% in the first quarter of 2021.

- Daily active users (DAUs) were 1.96 billion on average for March 2022, an increase of 4% year-over-year.

- Monthly active users (MAUs) were 2.94 billion as of March 31, 2022, an increase of 3% year-over-year.

- Ad impressions delivered across Meta’s Family of Apps increased by 15% year-over-year, while the average price per ad decreased by 8% year-over-year.

- Capital expenditures were $5.55 billion for the first quarter of 2022.

- Share repurchases were $9.39 billion in the first quarter of 2022.

- Cash and cash equivalents and marketable securities were $43.89 billion as of March 31, 2022.

- Headcount was 77,805 as of March 31, 2022, an increase of 28% year-over-year.

Overall, Meta’s first quarter results were mixed. Revenue grew slightly, but income from operations decreased. DAUs and MAUs both increased, but ad impressions and price per ad decreased. Meta is investing heavily in its metaverse initiatives, which is likely contributing to the decline in operating margin. However, the company still has a strong financial position and is generating a lot of revenue.

Positive Growth in Daily and Monthly Active Users

Under the highlight section of Meta’s Q1 2023 results, there are several key figures that hold significance for advertisers.

One of the most crucial metrics is the growth of family daily active people, encompassing Facebook, Instagram, WhatsApp, and other Meta apps.

In March 2023, the average number of daily active users reached a staggering 3.02 billion, indicating a five per cent increase compared to the previous year. Similarly, family monthly active people saw a five per cent increase, totalling 3.81 billion users.

These figures are incredibly promising for Facebook and Instagram advertisers as they signify a rising user base, providing more opportunities to target potential customers.

Debunking the Decline Myth

Addressing a common misconception, the data clearly demonstrate that Facebook’s popularity is not waning. Some argue that the decline in Facebook usage is primarily due to the growing popularity of Instagram and WhatsApp. However, the specific numbers reveal that Facebook’s daily active users reached 2.04 billion, showing a four per cent increase year over year.

Moreover, Facebook’s monthly active users grew by two per cent, reaching 2.99 billion. These figures dispel the notion that Facebook is losing its user base. On the contrary, the data suggest that more people are actively engaging with Facebook, strengthening its position as a viable advertising platform.

Increased Ad Impressions and Lower Costs

Another noteworthy aspect of the Q1 reports is the data concerning ad impressions and the cost per ad. The reports indicate a significant increase in ad impressions delivered across the family of apps, with a 26 per cent year-over-year growth.

This surge in ad serving can be attributed to an expanding user base and an increase in ads displayed. In line with basic supply and demand economics, this increase in supply has led to a reduction in the cost per ad served. The average price per ad decreased by 17 per cent compared to the previous year, resulting in lower costs for advertisers.

This decline in advertising costs opens up opportunities for businesses to reach their target audience more cost-effectively.

Implications for Advertisers and Marketers

The implications of this data for advertisers and marketers are highly encouraging. It is crucial to acknowledge that Facebook’s success extends beyond Instagram and WhatsApp, with Facebook itself experiencing consistent growth in daily and monthly active users.

Advertisers need to recognize the vast market potential Facebook offers and not dismiss it based on personal preferences or assumptions.

Billions of people worldwide continue to utilize Facebook, making it a powerful platform for reaching a diverse audience.

Optimism for Facebook and Instagram Advertising

The release of Meta’s Q1 2023 reports has shed light on the promising future of Facebook and Instagram advertising.

The data showcases steady growth in daily and monthly active users, debunking notions of a decline in Facebook’s popularity.

Furthermore, the increased ad impressions coupled with reduced costs per ad offer excellent prospects for advertisers seeking to maximize their ROI.

As the landscape of social media advertising evolves, it is crucial for marketers to stay updated with the latest strategies and techniques to ensure their campaigns deliver exceptional results.

By embracing the positive trends revealed in this data, advertisers can seize the opportunities presented by Facebook and Instagram to enhance their advertising endeavours.

Reference

Meta Reports First Quarter 2023 Results : https://investor.fb.com/investor-news/press-release-details/2023/Meta-Reports-First-Quarter-2023-Results/default.aspx